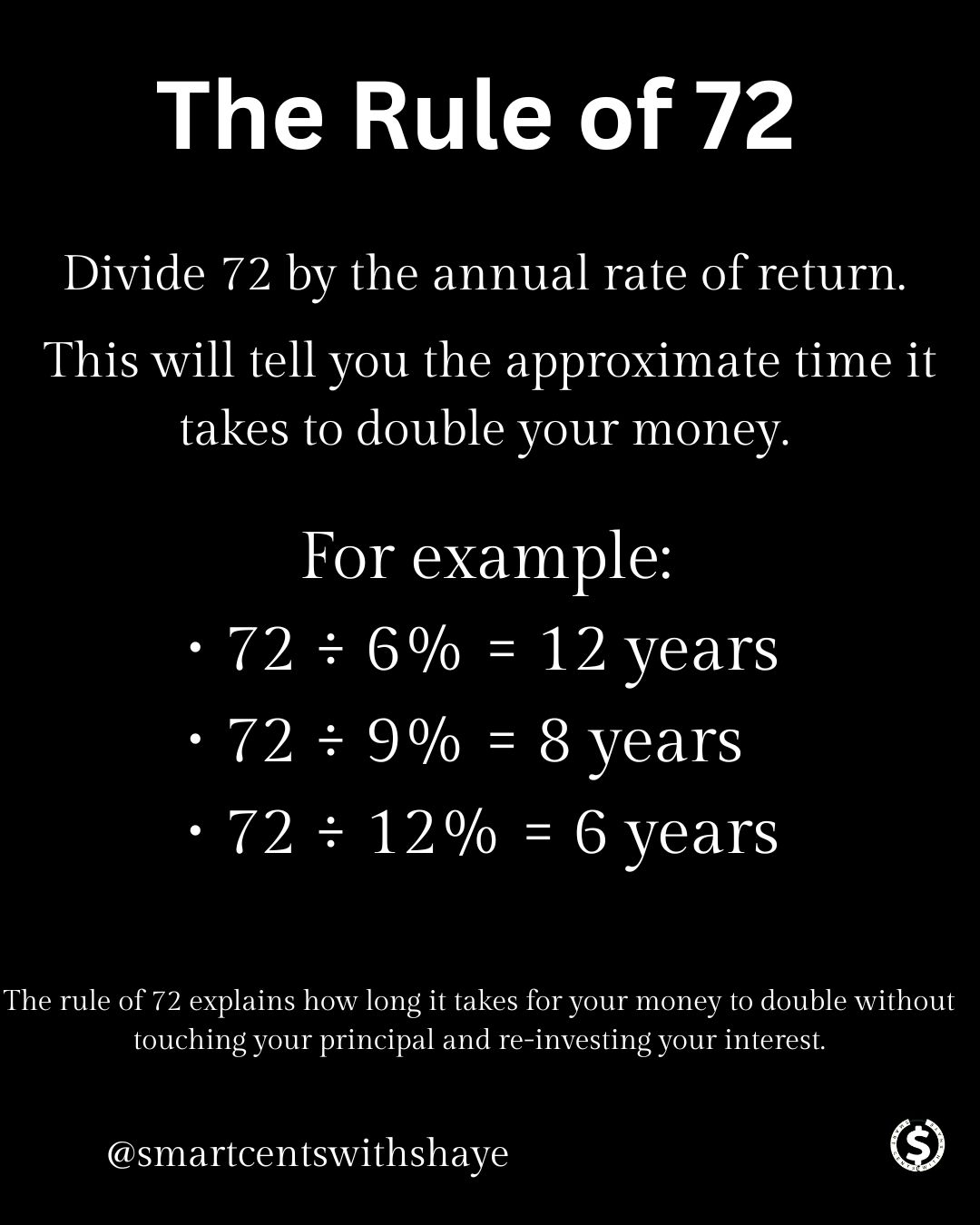

Investing can feel overwhelming, but one simple rule can provide clarity and help you make smarter financial decisions: the Rule of 72. This quick calculation reveals how long it takes for your investment to double, giving you insight into the power of compounding and helping you plan your financial future.

What is the Rule of 72?

The Rule of 72 is a simple formula to estimate how many years it will take for your investment to double based on your annual return rate.

For new investors, the rule of 72 is your pocket-sized wealth calculator. It beautifully demonstrates how your money can work harder than you do through the power of compound interest.

For example:

Albert Einstein once described compound interest as the “eighth wonder of the world,” saying, “he who understands it, earns it; he who doesn’t, pays for it.” Compound interest is when the interest one earns on a principal balance is reinvested and generates additional interest.

Why is it Important?

The Rule of 72 highlights the value of higher returns and starting early. A small difference in interest rates can significantly impact how quickly your money grows. Divide 72 by your expected annual rate of return, and you’ll get the approximate doubling time.

For example:

- 4% Return: Your investment doubles in 18 years.

- 8% Return: Your investment doubles in 9 years.

How to Use It in Your Investment Strategy

- Compare Investment Options: Use the rule to evaluate potential returns from stocks, bonds, or other assets.

- Understand Risk vs. Reward: Higher returns often come with higher risk. Balance your portfolio based on your goals and timeline.

- Start Early: The earlier you invest, the more doubling periods you’ll experience, maximizing your wealth over time.

Try playing with the Rule of 72 Calculator found here.

While effective, the Rule of 72 assumes consistent returns, which may not reflect market fluctuations. Always use it as a guideline rather than a guarantee.

The Rule of 72 is a powerful tool to simplify investing and illustrate the magic of compounding. By understanding this rule, you can make more informed financial decisions, set realistic goals, and stay motivated on your journey to financial freedom. Ready to take control of your investments? Start calculating, start planning, and watch your money work for you!

Leave a Reply