What is the Debt Avalanche Budgeting Method?

What is the Debt Avalanche Budgeting Method?

The debt avalanche method is a strategy for paying off debt that prioritizes tackling the highest interest-rate debt first, followed by the next highest-interest debt, and so on. This approach differs from the debt snowball method, which focuses on paying off the smallest balance first before moving to larger balances. By concentrating on interest rates, the debt avalanche method can save you more money over time.

Steps to Implement the Debt Avalanche Method

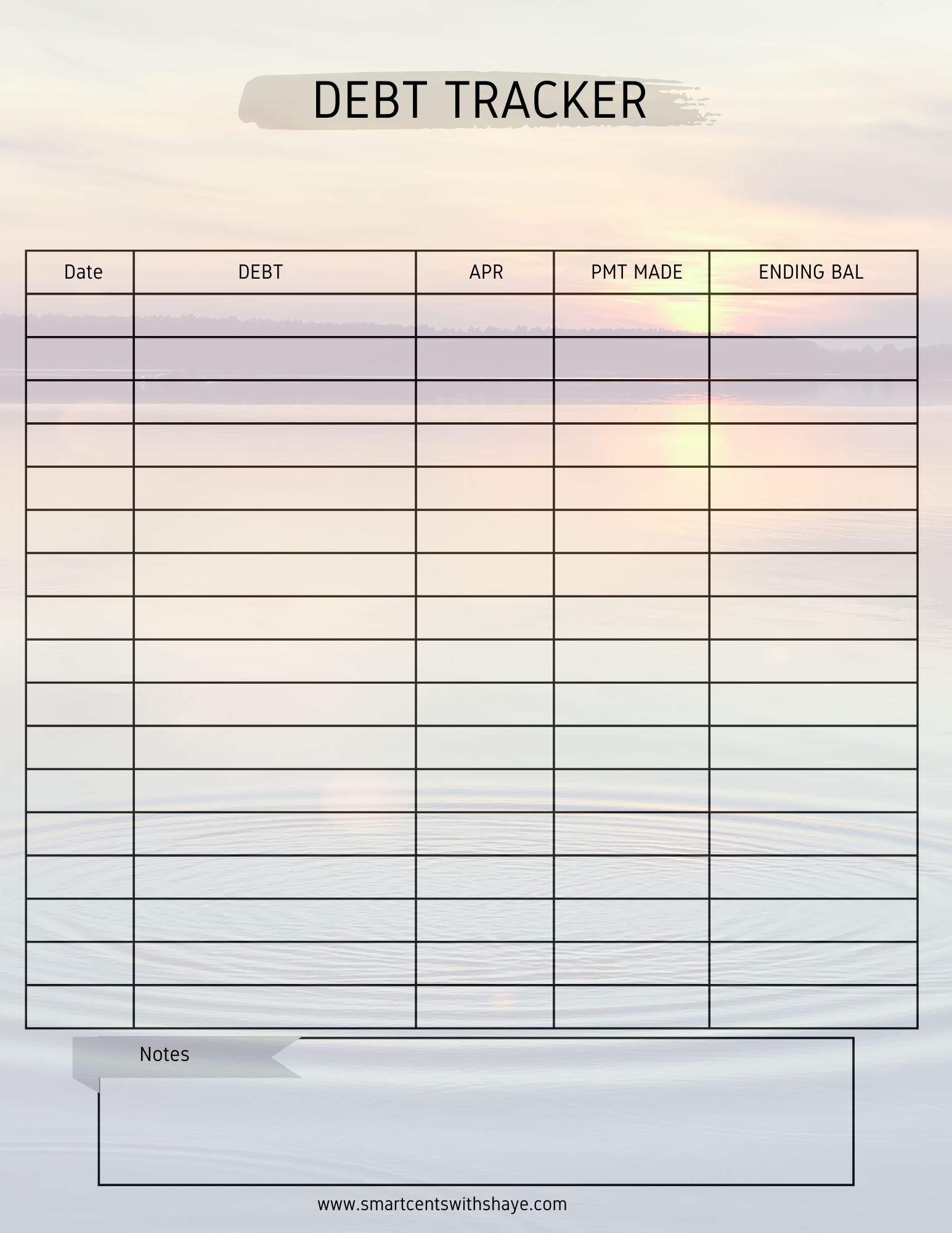

- Make a List of All Your Debts Gather information about each debt, including balances, interest rates (APR), and minimum payments.

- Rank Your Debts by Interest Rate Order your debts from the highest interest rate to the lowest.

- Create a Budget Track your income and expenses to determine how much extra money you can allocate toward paying off your highest-interest debt. This may involve cutting unnecessary expenses or finding additional income sources.

- Focus on the Highest-Interest Debt Pay the minimum payments on all your debts except the one with the highest interest rate. Apply all your extra money to the highest-interest debt until it is fully paid off.

- Repeat the Process Once the highest-interest debt is eliminated, redirect the freed-up funds to the next highest-interest debt. Continue this cycle until all debts are paid off.

Debt Avalanche Example

| Debt | Balance | APR | Monthly Payment |

| Credit Card 1 | $5,000 | 20% | $100 |

| Credit Card 2 | $1,200 | 14% | $20 |

| Credit Card 3 | $9,000 | 18% | $165 |

| Student Loan | $25,000 | 6% | $69 |

| Auto Loan | $12,000 | 3% | $330 |

In this scenario, Credit Card 1 is tackled first because it has the highest interest rate at 20%. You would make the minimum monthly payment of $100 plus any extra money you can afford to accelerate the payoff. After Credit Card 1 is paid off, you would move on to Credit Card 3 with an 18% interest rate, and so on.

Advantages of the Debt Avalanche Method

- Saves Money on Interest: By focusing on high-interest debt first, you minimize the total interest paid overtime.

- Efficient Debt Repayment: This strategy reduces the overall cost of your debt, by focusing on the higher interest rate first.

Disadvantages of the Debt Avalanche Method

- Patience Required: Since high-interest debts often have higher balances, it may take longer to see progress, which can be discouraging for some.

- Lack of Immediate Wins: Unlike the snowball method, this approach doesn’t provide the psychological boost of quickly eliminating smaller debts.

Is the Debt Avalanche Method Right for You?

The debt avalanche method is ideal for those who are disciplined, patient, and focused on minimizing the cost of their debt. However, if you need quick wins to stay motivated, consider other strategies like the debt snowball method.

Alternatives to the Debt Avalanche Method

- Debt Snowball Method: This method focuses on paying off the smallest balance first, providing quick wins to keep you motivated. Learn more about it here.

- 50/30/20 Budget Rule: This budgeting method divides your income into needs (50%), wants (30%), and savings/debt repayment (20%). Read about it here.

- Value-Based Budgeting: Focus on aligning your spending with your personal values and long-term goals. Check out my blog on value-based budgeting here.

Final Thoughts

The debt avalanche method is a powerful tool for those who are determined to save money and reduce debt efficiently. While it may not provide instant gratification, it’s a financially savvy approach to eliminating debt in the long run. Remember, the best method is the one that keeps you consistent and motivated on your journey to becoming debt-free.

I have attached a Google sheet Interest Debt Tracker for you.

Leave a Reply