10 Benefits of Budgeting

Your budget will help you set your future goals, whether small or long-term. Knowing how much money you have coming in and going out each month will give you insights into saving for a small or large-term goal.

Paying Off Debts

Creating a zero-based budget allows you to give every incoming dollar a place. A zero- based budget does not restrict you from spending, it allows you to choose how and where to spend your money. It gives you permission to spend while helping control your overall spending.

Save for Emergencies

Planning a head for those emergencies that everyone has from time to time will help you to not use a credit card or apply for a loan.

Saving for Retirement

If you know where your expenses are and where you can save or cut back so you can move more to your retirement accounts that makes it all worth it.

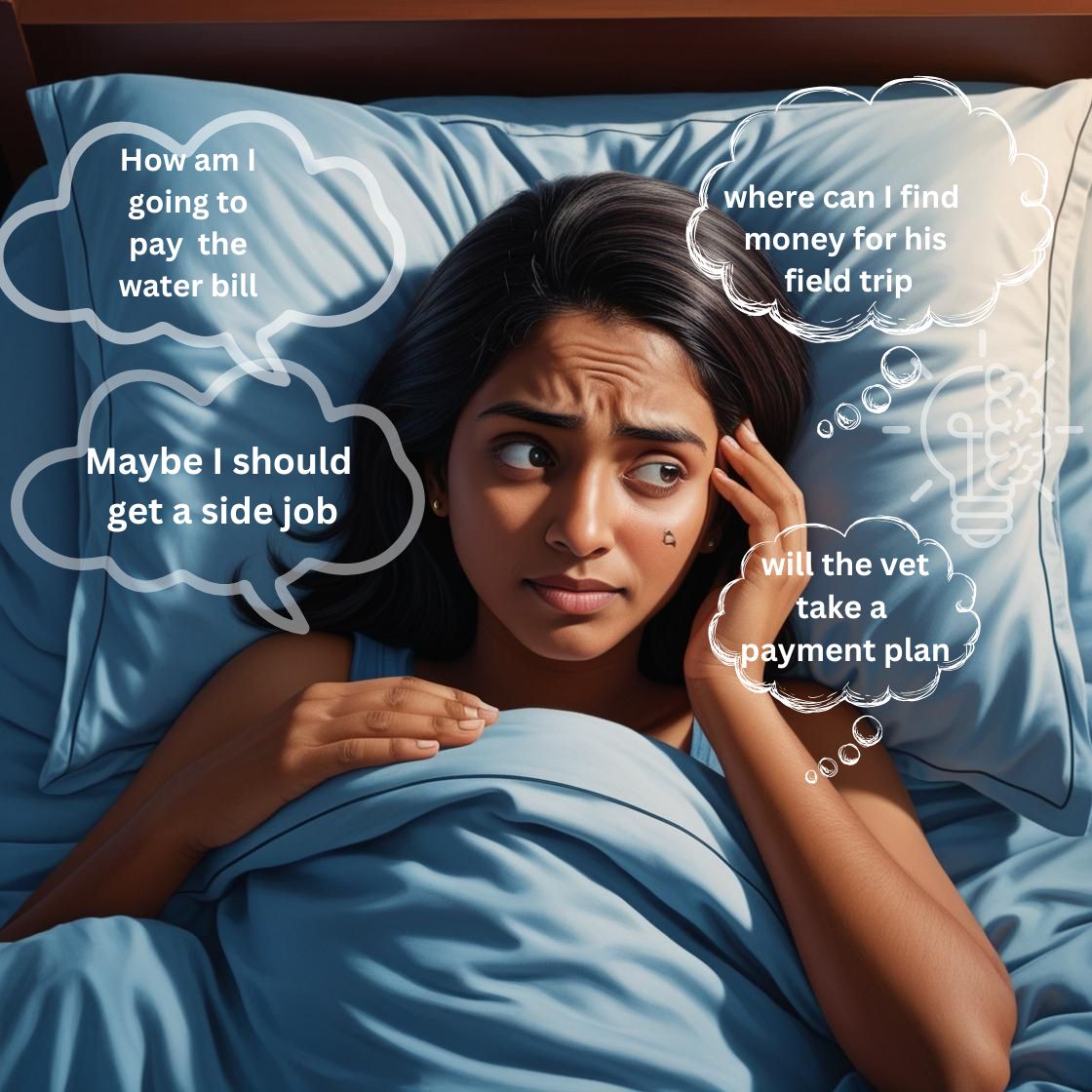

Peace of Mind

Knowing the status of your finances brings peace of mind. No late-night laying-in bed thinking how are you going to pay the electricity bill tomorrow.

Budgeting brings a Better Money Mindset

Once you see where your money is going and the freedom it gives you, your money mindset

is so much better. Managing your money is better for your health. Financial stress is real and can cause so much heartache.

Improves Communication in Relationships

Budgeting encourages open conversations about finances with partners or family members, reducing misunderstandings and promoting teamwork.

Helps Avoid Overspending

A budget creates boundaries, helping you recognize and resist unnecessary spending, especially on impulse buys.

Encourages Financial Discipline

Budgeting cultivates habits like tracking expenses and prioritizing needs over wants, setting you up for long-term financial success.

Allows You to Enjoy Life Guilt-Free

With a budget, you can set aside money for fun activities or indulgences without feeling guilty, knowing everything else is accounted for.

Empowers You with Financial Control

Budgeting shifts you from a reactive to a proactive approach with money, giving you confidence in managing your finances.

When you first create a budget, it will take a few times to get it right. Even a few months. You may forget about this expense or that. So, don’t worry, just stick with it. Before long you will be a budgeting expert. Here is a copy of a free Monthly Budget Planner to get you started.

Leave a Reply